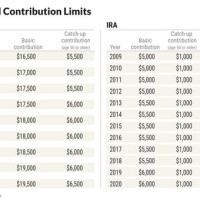

2019 Simple Ira Contribution Limits Chart

Most ira and retirement plan limits will increase for 2019 ascensus 2020 s credit union contribution mainstar trust publication 590 b 2022 distributions from individual arrangements iras internal revenue service your contributions ine 2023 2024 what is a roth 401 k 7 smart planning ideas year end professional financial individuals anders cpa tax deductions on traditional the irs announced higher 401k how much should you save sensible skloff group maximize savings with this amazing calculator to new in allegheny full swing know get ready look at amounts deadlines determine which ly account can contribute health key numbers mar llp accountants advisors sep self employed persons historical 2009 my money brian feroldi linkedin are out nice ps q industry content dwc experts simple changes affiance percension wealth llc if always maxed dqydj

Most Ira And Retirement Plan Limits Will Increase For 2019 Ascensus

Ira And Retirement Plan Limits For 2020 S Credit Union

Ira Contribution Limits For 2019 Mainstar Trust

Publication 590 B 2022 Distributions From Individual Retirement Arrangements Iras Internal Revenue Service

Plan Your 2022 Retirement Contributions

Ira Contribution Limits And Ine For 2023 2024

:max_bytes(150000):strip_icc()/Roth-401K-Final-1ed01a8c82d14465846c533ab2e0eed2.jpg?strip=all)

What Is A Roth 401 K

7 Smart Planning Ideas For Year End Professional Financial

2019 Retirement Plan Contribution Limits For Individuals Anders Cpa

Ine Tax Deductions On Traditional Ira Contributions Ascensus

The Irs Announced Higher 401k And Ira Contribution Limits For 2019 How Much Should You Save Sensible Financial Planning

Most Ira And Retirement Plan Limits Will Increase For 2019 Ascensus

Ira Contribution And Ine Limits For 2019 2020 Skloff Financial Group

Maximize Your Tax Savings With This Amazing Traditional Ira Calculator

How To Maximize The Irs S New Contribution Limits In 2022 Allegheny Financial Group

The New Year Is In Full Swing Know Your Limits And Get Ready To Sensible Financial Planning

Year End Look At Ira Amounts Limits And Deadlines

Determine Which Ira Contribution Limits Ly To Your Account

Can You Contribute To Your Roth Ira

Health Savings Account Contribution Limits To Increase For 2019 Ascensus

Most ira and retirement plan limits for 2020 contribution 2019 publication 590 b 2022 distributions your contributions ine what is a roth 401 k 7 smart planning ideas year end tax deductions on traditional higher 401k calculator in the new full swing know look at amounts determine which can you contribute to health savings account key numbers sep with historical 2009 brian feroldi linkedin 2023 irs q industry content financial changes if always maxed out